Those of us obsessed with the price of eggs and gasoline will have a larger target to worry about this year -- our upcoming property insurance bills. I have been conducting research about property insurance rates for an article in the upcoming Special Double Issue of my newsletter, Home On The Course.

It sounds rather mundane and bureaucratic, but nothing is likely to affect our collective pocketbook more significantly in the coming few years than property insurance. It is a disaster in waiting, one that has already arrived for tens of thousands of people across the country. Consider this: Because of the avalanche of claims they have had to pay out in recent years, insurers are petitioning state review boards for rate increases that range all the way up to 100%; even those not in particularly high-risk areas will see their premiums increase. That is better than for residents of higher risk areas whose insurance companies are dropping their coverage. That puts pressure on state governments to become the insurers of last resort, plans that Florida and California have already put in place.

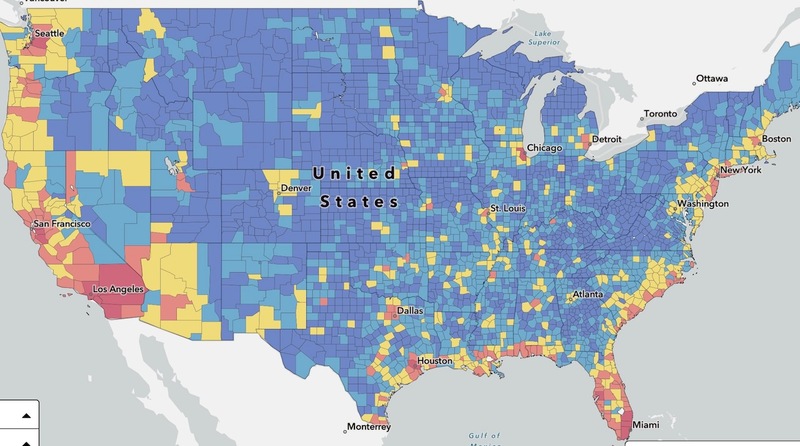

The map below, courtesy of FEMA, shows highest risk locations in rust color, next highest in yellow and safest in blue. Other risk maps I have seen paint an even more dire picture.

Here are the highlights from the upcoming double issue of Home On The Course.

• High-risk areas outnumber safe havens.

• Property insurance rates are doubling year to year in the highest risk areas and even in a few areas not at significant risk

• Some areas formerly deemed “safe” are suffering unspeakable disasters (e.g. western North Carolina in the wake of Hurricane Helene)

• Trailer parks and poorly constructed homes are not the only ones destroyed by tornadoes and wildfires; as I write this, hundreds of “mansions” have been burned to the ground in the hills surrounding Los Angeles.

• A reverse migration may be starting. People are relocating back to cold-winter states (e.g. New England) that are deemed safe and economically sound (per moving company data for 2024).

• State-run insurance plans (aka “insurers of last resort”) are at risk of being unable to pay claims. That could have financial consequences for all residents of those states.

The newsletter also features the year-end reports by three major van line companies that indicate where people are moving to and from. Two of the three most popular states came as a big surprise – West Virginia and Arkansas. South Carolina wasn’t. Oh, and John Denver’s hit song, "Country Roads," praises the allure of West Virginia. Or is it west Virginia? Subscribe here to find out.