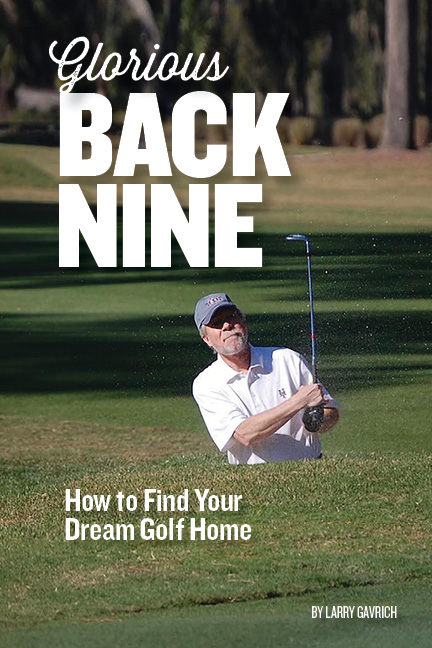

Water dominates the community of Hampton Lake in Bluffton, SC, but there is plenty of high-quality golf just outside the gates. Photo courtesy of Hampton Lake.

The best community in America, by one organization's reckoning, does not include a golf course, but that should be no problem for even the most devoted golfers. Bluffton, SC's, Hampton Lake, which just earned the prestigious "Best in American Living" Award, is within a golf cart ride of one private club -- Berkeley Hall, with 36 holes of Tom Fazio golf -- and just across the street from another, Hampton Hall, which features a Pete Dye course. John Reed, who has been developing properties in the area for 35 years, also developed the Berkeley Hall and Hampton Hall communities, as well as nearby Colleton River, which features two courses, one by Jack Nicklaus and one by Dye.

Hampton Lake received the nod at the National Home Builders Association show last week in the category of communities of more than 150 units. The awards are co-sponsored by the NHBA and Professional Builder magazine. The community opened in 2005 and spans 900 acres just nine miles from the bridge to Hilton Head Island. The area is as rich in well-regarded golf communities as any part of the southeastern U.S., a reality the developers of Hampton Lake factored into their decision to orient activities inside the gates toward a 165-acre lake rather than golf.

Hampton Hall and Berkeley Hall both offer equity memberships for just $10,000. However, dues are significantly different. At the more classic Berkeley Hall, you will pay about $12,500 per year, but membership brings full access to all the club's amenities as well as the two 18-hole golf courses. Dues at Hampton Hall and its one 18-hole course are just $4,000 per year, but only golf-related amenities are available there to Hampton Lake residents. (Hampton Lake, however, has a full complement of amenities other than golf.)

I have not played either of Berkeley Hall's two courses, but Tom Fazio is one of the nation's most consistent golf designers, and comments about the courses are uniformly positive. I walked the Hampton Hall course a couple of times while watching my son compete as a junior golfer a few years ago. The layout is what you would expect from Pete Dye, with mogul-marked fairways and bunkers shaped and sited to intimidate, at least visually. The fairways appeared to provide generous landing areas, and the large greens were not overly sloped. My major nitpick with Hampton Hall was the lack of vegetation and trees on and around the course, making a round on a hot day a brutal exercise and making the adjacent homes seem closer than they actually are.

Hampton Lake offers a total of 908 units across a range of home styles, from carriage and cottage designs to large estate homes. About 200 single-family lots remain, with prices starting at $120,000 and rising to $380,000, depending on lot size and view. Prices for finished homes begin in the $300s for the attached units and rise to seven figures. By comparison, homes in Berkeley Hall start at $725,000; Hampton Hall prices are more in line with those at Hampton Lake.

The Villas at Montelucia, a resort community at the foot of Camelback Mountain in Arizona, earned the Best in American Living award for communities of less than 150 units. The Residence at South Park near Charlotte, NC, earned the top distinction in the "smart growth/suburban" category, and Washington Town Center in Robbinsville, NJ earned the same award in the rural/exurban category. Nearby Miry Run Country Club in Robbinsville bills itself as a "public course with a private feel" and charges just $2,275 annually for a full family golf membership.

If you would like more information about Hampton Lake or any of the communities in the Bluffton, SC, area, or if you would like me to put you in touch with a pre-qualified agent who can arrange a visit and tour, please contact me and I will respond quickly.