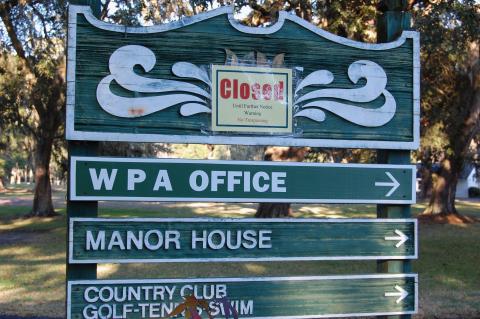

Upon our arrival on Saturday in Pawleys Island, SC, we were greeted with the news that the Wedgefield Plantation golf course had closed, the owners filing for Chapter 7 bankruptcy. I reviewed the course here in 2007 (click here for article).

Wedgefield, never rated near the top of Myrtle Beach's long roster of golf courses, nevertheless was sporty and fun to play. More importantly, it

When Wedgefield first opened in 1974, just at the beginning of the golf course explosion, Myrtle Beach offered around 35 courses, and Wedgefield found its way onto the list of courses open to package players down for a long weekend or buddy-golf week. But by the late 1980s, the Strand had become oversaturated with courses, topping the 120 mark. Today, the number is 95, and only the financially strong and well located survive.

Sadly, Wedgefield was not one of those and now finds itself in the dustbin of Myrtle Beach golf history along with Robbers Roost, Marsh Harbour, Beachwood, Deer Track, Bay Tree Plantation and half of the four courses at Wild Wing, all among the two dozen or so Myrtle Beach area courses that have closed since 2005. Add to that list Winyah Bay, the only other course in Georgetown and which, for a few years, held the distinction of furthest southern course on the Grand Strand. It closed in 2005. Efforts to sell lots and build homes on the former course have fallen well short of expectations, and four years later, just a couple of homes have been built there.