Half Million People Leave Florida. Why?

In 2022, according to the U.S. Census Bureau, 490,000 people left Florida for other states. But lest you think Florida is bleeding population, more than 740,000 people moved into the state, most of them from the usual sources – New York, New Jersey and California. Florida remains a magnet for retirees seeking warmth and sunshine during the winter months, as well as perceived lower costs. (I explain “perceived” below.) And despite the stories about traffic and infrastructure issues across the state, the latest census figures put the lie to one of Yogi Berra’s most charming malaprops: “No one goes there anymore. It’s too crowded.” (Note: Yogi was talking about a restaurant.)

When I saw the headline at the Florida Insider website about Florida’s outward migration, I thought that politics played a part in the decision for so many to flee the state. After all, Florida’s government has been in the headlines for the past couple of years for enacting legal restrictions that make many people nervous. But a quick scan of the Florida Insider article indicated that the recipients of most of the population outflows from Florida are other conservative states like Georgia, North Carolina and Tennessee.

Hurricane Ian entered Florida via the Gulf of Mexico, exited on the east coast and then traveled up the Carolinas coasts. Ian caused more than $112 billion in damage.

Hurricane Ian entered Florida via the Gulf of Mexico, exited on the east coast and then traveled up the Carolinas coasts. Ian caused more than $112 billion in damage.But the same reasons, besides climate, that drive people to Florida are, ironically, the reasons many are leaving, and that is the cost of living in the state. The state’s lack of an income tax makes it appealing, certainly to wealthy people who live there for six months and a day and then return for the spring and summers to the New England and mid-Atlantic states, where healthcare, for example, is rated far superior to Florida’s services. (Six months and a day is all you need to declare yourself a resident and avoid state income taxes in the other state where you reside part-time.) In terms of quality of healthcare, Massachusetts and Connecticut are ranked #2 and #5, respectively, by USNews&WorldReport, whereas Florida is ranked 27th; that includes a miserable ranking of 48th in terms of health care access.

But Florida’s cost of living is becoming something of a fool’s gold for those without substantial financial resources. Rising seawaters and hurricanes have driven insurance premiums sky high in the state, causing some national insurers to throw up their hands and stop providing any coverage there. According to the Insurance Information Institute, Florida homeowner insurance costs increased 40% on average last year alone. (Florida insurance rates are four times the national average.) Rates had risen significantly in the four previous years, largely because insurers in the state had paid out more than $51 billion in claims during that time. (Side note: Florida leads the nation with a 74% rate of homeowner insurance litigation. Of the $51 billion paid out for claims, claimants received just 8% of the total; the rest went to attorneys and public administration – a situation that seems unsustainable.)

Caveat emptor for people who intend to bequeath their Florida coastal homes to their children.

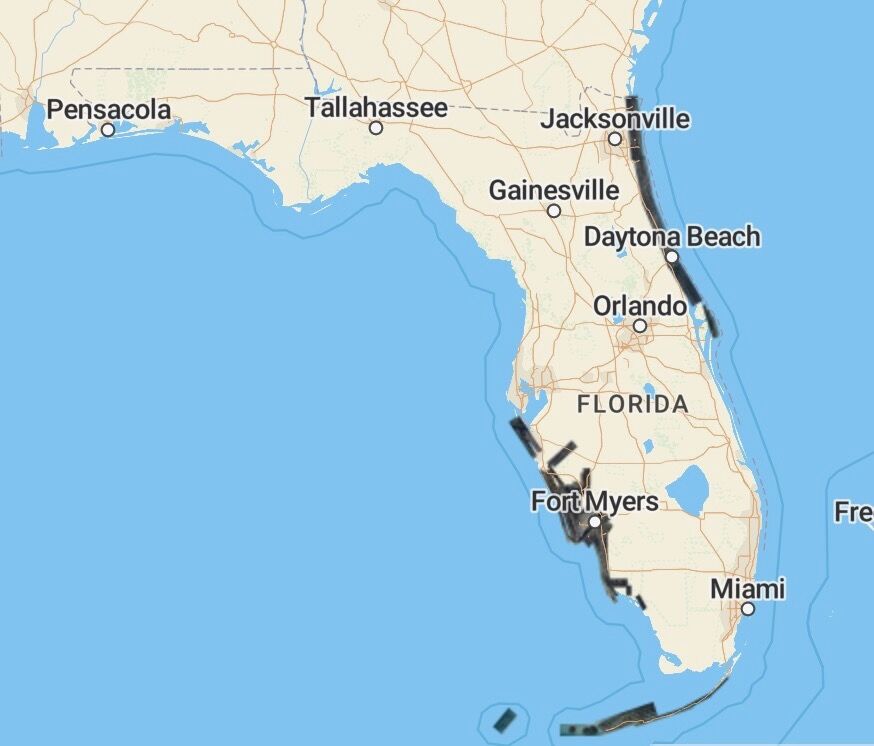

The average annual cost of flood insurance in Florida is $910 but can range up to $3,000 and more depending on risk factors. Having a home on the ocean in Florida is a wonderful thing, but you will pay bigtime for the view and easy access to the beach – and maybe a lot more in the event of a major hurricane. According to the web site RiskFactor.com, which assesses flooding and other risks for virtually every property in the nation, most of the Florida coastline is at “major,” “severe” or “extreme risk” of danger from climate events (flooding, wind and heat). Almost all the state’s Gulf of Mexico coastline is a darker shade of blue and black, indicating the highest levels of risk.

As an example, a home in Naples is currently for sale in the golf community known as Lely. RiskFactor.com indicates the house, which is about four miles as the crow flies from the Gulf of Mexico, has a 98% chance of at least a foot of flooding over the coming 30 years, and an 11% chance of that happening this year. The site warns that flood insurance coverage may be mandatory for the home. In addition, the risk of tropical storms affecting that area of Florida is 10 out of 10; that translates as an 8% risk this year of winds up to 100 mph, with a 73% risk of that happening over the next 15 years and a 92% chance over the next 30 years. Caveat emptor for people who intend to bequeath their Florida coastal homes to their children.

Although Hurricane Ian caused less havoc on the South Carolina coast than it did on Florida’s Gulf Coast, clean-up was still substantial. Photo of a boat dock that traveled a half mile across the marsh to its resting place between the 13th and 17th tee boxes at Pawleys Plantation in Pawleys Island.

Although Hurricane Ian caused less havoc on the South Carolina coast than it did on Florida’s Gulf Coast, clean-up was still substantial. Photo of a boat dock that traveled a half mile across the marsh to its resting place between the 13th and 17th tee boxes at Pawleys Plantation in Pawleys Island.And the insurance cost increases are not just related to weather that could damage real estate holdings. According to BankRate.com, costs to insure cars in the state have risen more than 47% between 2021 and 2023. Overall, the cost of living in Florida is higher than many people suspect. Average cost of a home in the state was $410,000 last April compared with a national average of $388,000, according to the Florida Association of Realtors. And according to Rent.com, median monthly rent in Orlando was $2,153 last may; in Miami it was a whopping $3,066. The nationwide median rent? $1,967.

For those who can afford it, the state of Florida provides just about the best winter climate in the nation. Almost twice as many people are still moving to Florida than are leaving. But more people than ever – in raw numbers – are leaving, and not just to go to their final rewards. The emigration trend could be a sign that no one single factor is the cause, but that the cost of living – especially insurance costs – and climate issues – especially hurricanes – and an increasing population density may begin to slow inward migration and topple Florida’s status as the most popular state for retirees. Caveat emptor.

Your Next Home Not Getting Bigger;

It’s Getting Better

According to a presentation at this year’s International Builders’ Show, your choice of your next house will be smaller – and “better.” Architect Donald Ruthroff told attendees that, “Our homeowners are looking to personalize their homes. They want it to feel like it was made just for them and be significantly different than their neighbors’ homes.”

He might have added that, in certain parts of the nation, including the Southeast Region, skimpy inventories of homes for sale are encouraging developers to build smaller homes closer together, thereby maximizing their returns on investment. In short, buyers may have no choice but to “prefer” smaller homes since those homes are, more and more, the only new ones available in significant quantities. Whether builders will make those homes “better” – that is, easier to personalize – remains to be seen.

Architect Ruthroff also presented his list of eight design trends he took away from a recent residential design awards program. They are:

- Better replaces bigger

- Bespoke replaces ready-made

- Midcentury replaces farmhouse

- Softness replaces hardness

- Traditional replaces contemporary

- Attached living replaces detached

- Outdoor living replaces indoor (Ed. Note: Assume that doesn’t mean sleeping in tents.)

- Community replaces neighborhood

Note that last design trend. If you live in a golf community, or are looking to, consider yourself a trendsetter.

Thanks for reading,

Larry Gavrich

Founder & Editor

Home On The Course, LLC